“This is one of the biggest mistakes people believe about credit scores, but they do not keep you from getting a job,” says Rod Griffin, Experian’s senior director of consumer education.Īnother common misconception is that your FICO score will be used in insurance underwriting, says Ethan Dornhelm, vice president of scores and predictive analytics at FICO. That’s because the particular window credit scores offer into your creditworthiness isn’t considered relevant to hiring decisions, according to Experian. While companies can access a modified version of your credit file containing details about past payment behavior and outstanding debt, credit scores are excluded. That’s because a good or bad credit score could be a deal breaker for some daters 42% of Americans told Bankrate that knowing someone’s credit score could be a deciding factor in whether a match moved into the friend zone or went the distance.Įmployment is one area of your life your FICO credit score can’t directly impact-though your credit report can. Your FICO score may even affect your love life. Small-business owners applying for a loan will also find that their personal credit scores factor into lenders’ decision making in tandem with their business credit score. While a poor FICO score won’t necessarily keep you from renting, it could lead you to need a cosigner, roommate, past landlord references, additional proof of income, or a shorter lease period to actually land that space.Īdditionally, mobile phone, cable, and utility companies may also review your credit score, says Gerri Detweiler, an author of several books on credit and other personal finance topics.

Many landlords check an applicant’s credit score and credit report searching for a solid record of on-time payments and no red flags like accounts in collections. If you’re applying for a personal loan, auto loan, student loan, mortgage, home-equity loan, or credit card, odds are very high the lender will check your FICO score before deciding whether to grant your credit request.īut your FICO score could also play a part in other transactions. It aimed to make lender credit decisions fairer to consumers by excluding personal details like gender, race, age, and political affiliation that previous companies’ credit score calculations had included.

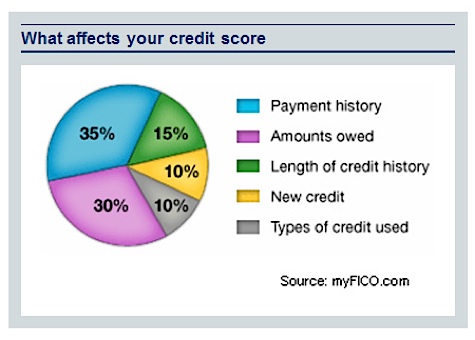

The strength of your score can affect whether you’ll be approved for new credit, the amount you can borrow, the repayment timeline for your loan, and the interest rate you’ll pay.įICO designed its scoring model to provide a standard way to assess creditworthiness that took into account only information contained on the credit reports prepared by the three national credit bureaus, Experian, Equifax and TransUnion. This number, created with the help of computer-powered statistical analysis, is designed to tell lenders how likely you are to repay your loans. Created by the Fair Isaac Corporation in 1989, FICO scores distill the data on your credit reports, such as how much debt you have and whether you consistently pay your bills on time, into a single three-digit number.

0 kommentar(er)

0 kommentar(er)